Tesla (TSLA) is about to launch Q2 2024 monetary outcomes on Tuesday, July 23, after the markets shut. As normal, a convention name and Q&A with Tesla’s administration are scheduled after the outcomes.

Right here, we’ll check out what each the road and retail traders expect for the quarterly outcomes.

Tesla Q2 2024 deliveries

Whereas Tesla is an “AI/robotics” firm, in accordance with CEO Elon Musk, its automotive deliveries stay the largest drivers of monetary efficiency by far.

Tesla already disclosed its Q2 car supply and manufacturing numbers:

| Fashions | Manufacturing | Deliveries | Topic to working lease accounting |

| Mannequin 3/Y | 386,576 | 422,405 | 2% |

| Different Fashions | 24,255 | 21,551 | 1% |

| Complete | 410,831 | 443,956 | 2% |

Deliveries are down year-over-year for the second quarter in a row, however the efficiency was significantly better than final quarter.

Tesla has additionally already disclosed a powerful new report deployment of vitality storage at 9.4 GWh.

Tesla Q2 2024 income

For income, analysts typically have a reasonably good thought of what to anticipate, due to the supply numbers.

Nevertheless, Tesla’s common value per car is altering loads nowadays because of frequent value cuts and reductions throughout many markets, which makes issues harder.

This quarter, Wall Road additionally has to account for the report vitality storage, which is including billions of {dollars} to income.

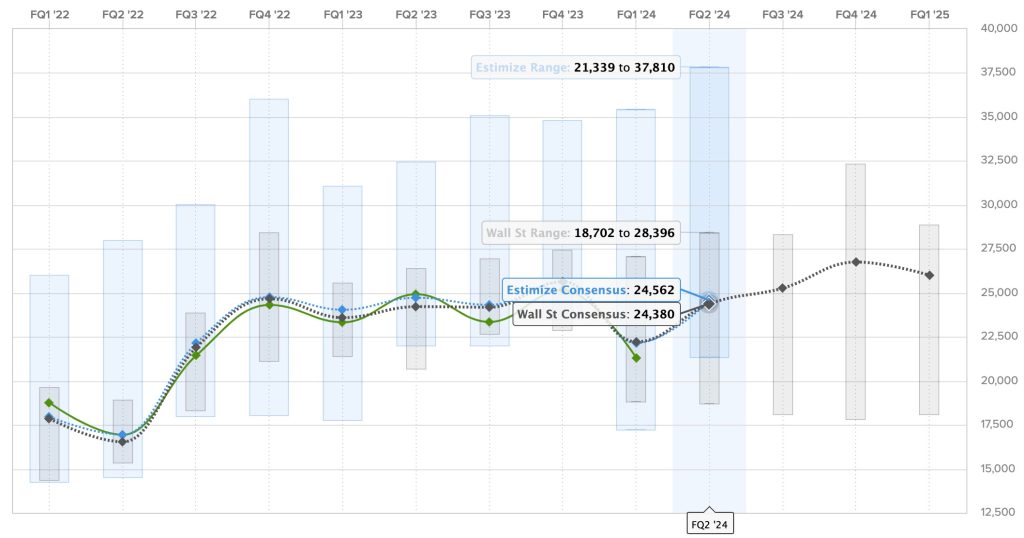

The Wall Road consensus for this quarter is $24.380 billion, and Estimize, the monetary estimate crowdsourcing web site, predicts the next income of $24.562 billion.

Listed below are the predictions for Tesla’s income over the previous two years, with Estimize predictions in blue, Wall Road consensus in grey, and precise outcomes are in inexperienced:

Tesla Q2 2024 earnings

Tesla all the time makes an attempt to be marginally worthwhile each quarter because it invests most of its cash into progress, and it has been profitable in doing so over the past three years now.

Nevertheless, like revenues, it has been more durable to estimate earnings over the past yr with value cuts digging into Tesla’s industry-leading gross margins and the decrease deliveries are making it more durable.

For Q2 2024, the Wall Road consensus is a acquire of $0.61 per share, whereas Estimize’s prediction is barely increased with a revenue of $0.64 per share.

Tesla had earnings of $0.91 per share throughout the identical interval final yr.

Listed below are the earnings per share over the past two years, the place Estimize predictions are in blue, Wall Road consensus is in grey, and precise outcomes are in inexperienced:

Different expectations for the TSLA shareholder’s letter and analyst name

Past the monetary outcomes, Tesla all the time offers broader updates and solutions shareholder questions in its shareholder letter and convention name with administration following the discharge of the outcomes.

Tesla gathers questions from shareholders from the “Say Applied sciences” web site.

Listed below are the at the moment most upvoted questions more likely to be answered by administration:

- When precisely is the robo taxi occasion if not 08/08

- When do you anticipate the primary Robotaxi trip?

- What are Tesla’s 2 greatest precedence for subsequent 5 years?

- What’s the present standing of 4680 battery cell manufacturing and the way is the ramp-up progressing?

- When do you anticipate Optimus to be obtainable for buy?

I’ve to say that these are horrible questions, nevertheless it’s not too shocking contemplating the place Tesla shareholders are right now. They’re nearly all about Tesla’s program delays, they usually have all been answered considerably not too long ago.

If you wish to concentrate on the optimistic, I’d ask concerning the state of vitality storage gross margin amid the brand new report deployment. That will make a giant distinction.

However I believe probably the most impactful a part of the earnings may find yourself being a steerage change for the yr. With the primary two quarters being down year-over-year, there’s a danger that Tesla may not have the ability to flip issues round within the second half of the yr and it must regulate steerage for the yr.

Tune in after market shut for our protection of the shareholder’s letter and the convention name.