Tesla (TSLA) is reportedly seeking to elevate nearly $800 million from a debt sale backed by its auto leases.

Bloomberg reported the transfer, which Tesla is reportedly premarketing the debt sale to the market proper now:

The deal, being run by Societe Generale, can be the electric-vehicle maker’s second transaction of the 12 months and is predicted to cost subsequent week, in accordance with an individual accustomed to the matter who requested to be recognized as they’re not approved to talk publicly. March’s $750 million deal had a 5.53% coupon on its prime tranche.

As rates of interest began to go down this 12 months, automotive asset-backed safety (ABS) offers have picked up.

Ford simply did a $1.7 billion ABS deal and Tesla did one earlier this 12 months.

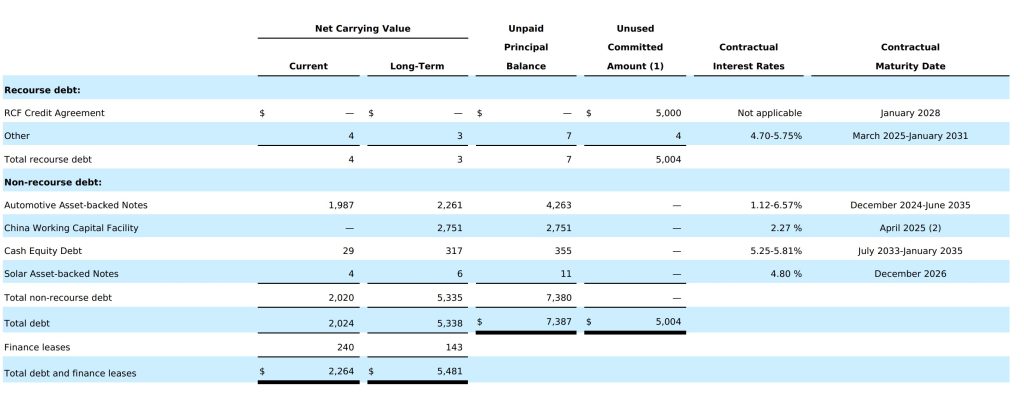

As of its newest reported quarter (Q2 2024), Tesla had over $4.2 billion in ABS notes:

Tesla can be sitting on $30 billion in money, money equal, and short-term investments on the finish of final quarter