Tesla has pulled the heavy weaponry in terms of financing to spice up gross sales throughout its common end-of-quarter push.

Tesla has commonly launched value cuts and incentives on the finish of each quarter with a purpose to enhance gross sales and decrease stock.

It helps quarterly monetary outcomes look higher as Tesla has already spent the cash to construct these autos and if they aren’t delivered by the top of the quarter, they find yourself in its “stock” with out producing any income.

Not too long ago, Tesla launched, or reintroduced, incentives throughout its complete EV lineup aside from the Cybertruck.

For instance, the automaker carried out a brand new referral program, which mainly lead to a $1,000 low cost on new automobiles.

Currently, Tesla has been subsidizing financing on its autos as a incentive.

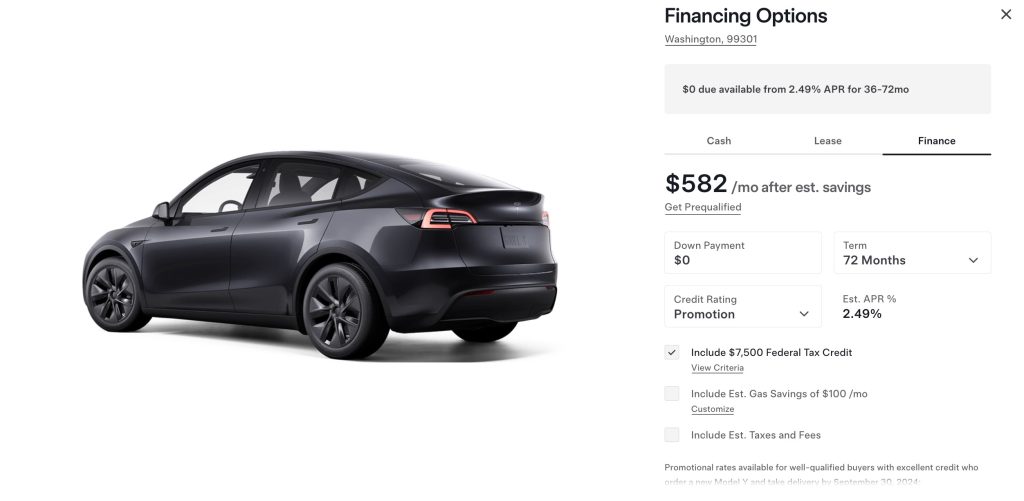

Now, the automaker has launched zero down cost on Mannequin 3 and Mannequin Y autos, which could be mixed with a lot decrease APR:

If you happen to put an ‘wonderful’ credit standing in Tesla’s on-line configurator, you get a 5.59% rate of interest, however if you happen to select the brand new “promotion” credit standing, Tesla is providing 0$ down cost and APR at 2.49%.

With a small down cost, you will get the speed all the way down to 1.99%.

The promotion is working till September 30, which coincides with the top of the quarter.

Electrek’s Take

This is perhaps Tesla’s greatest promotion of the 12 months. In comparison with present rates of interest, 2% is mainly free cash and the truth that nothing is due at supply ought to appeal to lots of people.

I might anticipate that it’ll assist Tesla clear its US stock this quarter.

Nevertheless, as now we have beforehand reported, gross sales are flat in China and approach down in Europe.

Subsequently, it’s nonetheless unclear if Tesla can develop gross sales this quarter. The automaker delivered 444,000 autos final quarter and 435,000 autos in Q3 2023.

Tesla is at present monitoring to have its first 12 months with a discount in EV deliveries in a decade.

Buyers can even be monitoring revenue margins as this new referral program and the subsidizing of financing ought to negatively influence margins.